Autonomous AP

Real AI that does the work for you

AppZen’s finance AI is the fastest way to impact your bottom line across invoices, expenses, and cards.

For AP Teams

AI-first AP:

Set it and forget it

Streamline your accounts payable process with AI

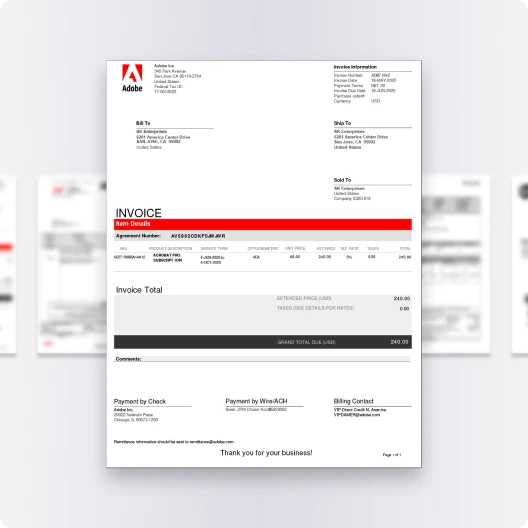

Remove the hassle of templates and OCR reviews. AI-powered Autonomous AP accurately digitizes and validates all invoice data, assigns account codes, matches to complex, multi-line POs, and audits every invoice for compliance violations until OK-to-pay. So easy, you’ll forget it’s there.

- 100% guaranteed entry of every invoice in minutes, no matter how complex

- GL code assignment and PO matching for every invoice

- More output, same headcount

For T&E Teams

Every receipt, every time

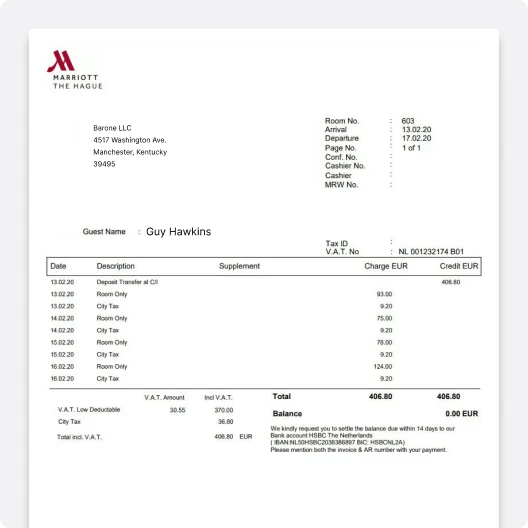

Customize your expense policies and streamline enforcement

Our AI finds sneaky purchases and duplicate claims instantly, analyzes every item purchased from wine to jewelry, and enables customizable policies. Get best-in-class T&E compliance and delight employees with faster reimbursements.

- Combine receipt data, online social sources, MCC codes, and more to find suspicious charges other solutions can’t

- Automate compliance and approvals in every language and country in which you operate

- AI does the work so your people don’t have to

For card Teams

Pick a card, any card

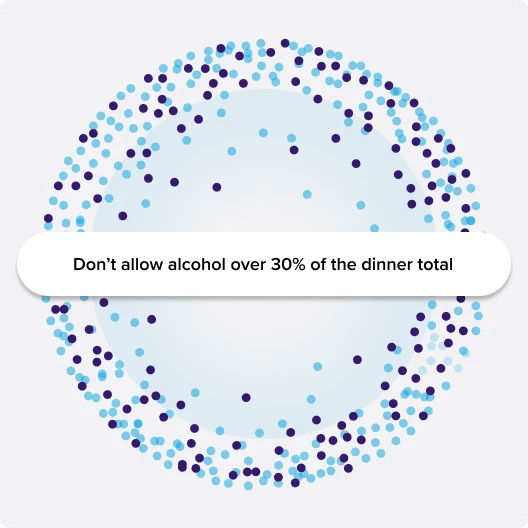

Real-time compliance for your card program

With Card Audit, 100% of your corporate cards, P-card, and even ghost card transactions are audited for spend compliance almost immediately. Enforce controls and prevent out-of-policy card purchases. No sleight of hand gets by you.

- AI catches unauthorized spending no other software can

- Automatically categorize, audit, and reconcile expenses

- Detect abuse and fraudulent behavior across all cards and expense reports in a single interface

WHY APPZEN?

Our AI is the most experienced team member you never hired

Finance-trained AI learns and understands your business and accounting practices like a pro, never goes on vacation, speaks multiple languages, and even reads and routes your emails, with 100% guaranteed accuracy across all your spend.

Learn More

Integrate with existing systems in minutes

Our integrations are easily installed with minimal IT effort and can show ROI within days of implementation.

Back in the day, 40 accountants spent approximately 5 hours per month auditing expense reports. Now it’s 1 accountant spending maybe 2 hours a month.Central Banking & Support Accountant

With AppZen’s Al, we can see and focus on the most frequent, high-risk reasons and drive behavioral or policy changes.Global Indirect Purchasing Manager

AppZen helped us get control of our costs and, more importantly, shape people's behavior.Global Compliance Manager

Purely from an AP perspective, it's really consolidating the platforms and eliminating a lot of manual effort in that process.Global Compliance Manager

Schedule a demo, today.

Contact us to set up a demo of our platform with one of our friendly enterprise account executives.

Schedule a DemoLeading Al-powered expense auditing & accounts payable

Platform brief: Autonomous spend-to-pay processing

Here’s how our AI-driven autonomous spend-to-pay platform touchlessly controls enterprise spend to reduce risk, cost, and payment friction.

Download now

Guide to Autonomous AP

Finance automation can’t fix the problems inherent to traditional AP processes. Discover the strategic benefits of autonomous solutions and 7 requirements for deployment success.

Download now

Why Georgetown’s AP team adopted an AI solution that loves to learn

Georgetown University’s 9-person AP team needed an invoice processing solution that could adapt to t...

More